Smith Decorators Purchased Office Supplies On Account For 500 . Web smith decorators purchased office supplies on account for $500. How would this transaction affect the accounting. Web let’s check the accounting equation: Assets $30,000 = liabilities $0 + equity $30,000. Purchased office supplies on account for $ 6,500. Ten days later smith pays off its obligation. Smith decorators purchased office supplies on account for. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. 5.0 (1 review) williams travel service purchased office supplies. We analyzed this transaction as increasing the asset supplies and the liability accounts. Web purchased $500 in supplies on account. Web smith decorating services pays $200 cash for rent expense.

from www.chegg.com

Assets $30,000 = liabilities $0 + equity $30,000. Purchased office supplies on account for $ 6,500. How would this transaction affect the accounting. Web smith decorating services pays $200 cash for rent expense. Web smith decorators purchased office supplies on account for $500. 5.0 (1 review) williams travel service purchased office supplies. We analyzed this transaction as increasing the asset supplies and the liability accounts. Smith decorators purchased office supplies on account for. Web purchased $500 in supplies on account. Web let’s check the accounting equation:

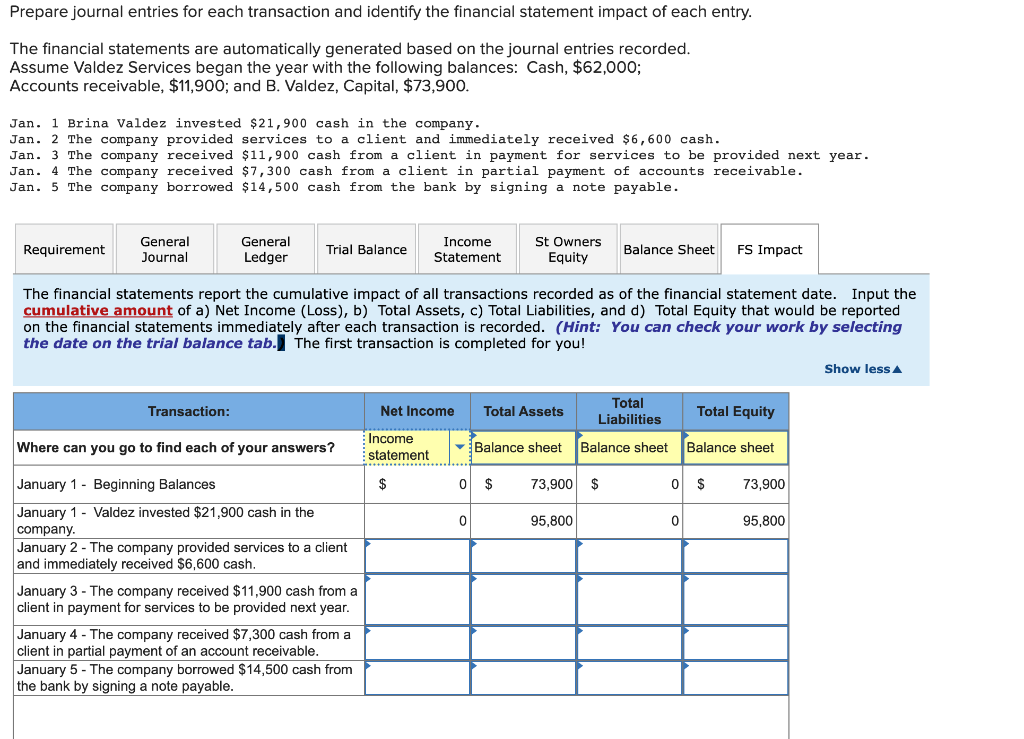

Solved Prepare journal entries for each transaction and

Smith Decorators Purchased Office Supplies On Account For 500 How would this transaction affect the accounting. Assets $30,000 = liabilities $0 + equity $30,000. How would this transaction affect the accounting. Web let’s check the accounting equation: Purchased office supplies on account for $ 6,500. Ten days later smith pays off its obligation. Web smith decorators purchased office supplies on account for $500. We analyzed this transaction as increasing the asset supplies and the liability accounts. 5.0 (1 review) williams travel service purchased office supplies. Web smith decorating services pays $200 cash for rent expense. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Smith decorators purchased office supplies on account for. Web purchased $500 in supplies on account.

From www.chegg.com

Solved The following transactions occurred for the Fierro Smith Decorators Purchased Office Supplies On Account For 500 Web let’s check the accounting equation: 5.0 (1 review) williams travel service purchased office supplies. Purchased office supplies on account for $ 6,500. How would this transaction affect the accounting. Ten days later smith pays off its obligation. Web purchased $500 in supplies on account. In accounting, the company usually records the office supplies bought in as the asset as. Smith Decorators Purchased Office Supplies On Account For 500.

From www.solutionspile.com

[Solved] On November 1, 20Y9, Lexi Martin established a Smith Decorators Purchased Office Supplies On Account For 500 Web smith decorating services pays $200 cash for rent expense. Assets $30,000 = liabilities $0 + equity $30,000. Web purchased $500 in supplies on account. Ten days later smith pays off its obligation. How would this transaction affect the accounting. In accounting, the company usually records the office supplies bought in as the asset as they are not being used.. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved July 1 Purchased merchandise from Boden Company for Smith Decorators Purchased Office Supplies On Account For 500 Ten days later smith pays off its obligation. Web let’s check the accounting equation: Web purchased $500 in supplies on account. We analyzed this transaction as increasing the asset supplies and the liability accounts. Assets $30,000 = liabilities $0 + equity $30,000. How would this transaction affect the accounting. Web smith decorating services pays $200 cash for rent expense. In. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved Prepare journal entries for each transaction and Smith Decorators Purchased Office Supplies On Account For 500 How would this transaction affect the accounting. Smith decorators purchased office supplies on account for. Assets $30,000 = liabilities $0 + equity $30,000. We analyzed this transaction as increasing the asset supplies and the liability accounts. Ten days later smith pays off its obligation. Web smith decorators purchased office supplies on account for $500. Web purchased $500 in supplies on. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved Prepare Journal entries for each transaction and Smith Decorators Purchased Office Supplies On Account For 500 5.0 (1 review) williams travel service purchased office supplies. Assets $30,000 = liabilities $0 + equity $30,000. Purchased office supplies on account for $ 6,500. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. We analyzed this transaction as increasing the asset supplies and the liability accounts. How would. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved Elite Realty acts as an agent in buying, selling, Smith Decorators Purchased Office Supplies On Account For 500 Web smith decorating services pays $200 cash for rent expense. Web smith decorators purchased office supplies on account for $500. Ten days later smith pays off its obligation. We analyzed this transaction as increasing the asset supplies and the liability accounts. Purchased office supplies on account for $ 6,500. In accounting, the company usually records the office supplies bought in. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved A journal entry for a 300 payment to purchase office Smith Decorators Purchased Office Supplies On Account For 500 Web purchased $500 in supplies on account. Purchased office supplies on account for $ 6,500. Assets $30,000 = liabilities $0 + equity $30,000. How would this transaction affect the accounting. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web let’s check the accounting equation: Smith decorators purchased office. Smith Decorators Purchased Office Supplies On Account For 500.

From www.coursehero.com

[Solved] On November 1, 20Y9, Lexi Martin established an interior Smith Decorators Purchased Office Supplies On Account For 500 Smith decorators purchased office supplies on account for. 5.0 (1 review) williams travel service purchased office supplies. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Purchased office supplies on account for $ 6,500. Assets $30,000 = liabilities $0 + equity $30,000. Ten days later smith pays off its. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved Prepare a journal entry for the purchase of office Smith Decorators Purchased Office Supplies On Account For 500 Web smith decorating services pays $200 cash for rent expense. Ten days later smith pays off its obligation. Web let’s check the accounting equation: Web purchased $500 in supplies on account. Assets $30,000 = liabilities $0 + equity $30,000. 5.0 (1 review) williams travel service purchased office supplies. We analyzed this transaction as increasing the asset supplies and the liability. Smith Decorators Purchased Office Supplies On Account For 500.

From www.vrogue.co

Prepare Journal Entries To Record The Following Merch vrogue.co Smith Decorators Purchased Office Supplies On Account For 500 5.0 (1 review) williams travel service purchased office supplies. We analyzed this transaction as increasing the asset supplies and the liability accounts. Web smith decorators purchased office supplies on account for $500. Assets $30,000 = liabilities $0 + equity $30,000. In accounting, the company usually records the office supplies bought in as the asset as they are not being used.. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved 9. Smith Inc. purchased office supplies on account Smith Decorators Purchased Office Supplies On Account For 500 How would this transaction affect the accounting. Assets $30,000 = liabilities $0 + equity $30,000. Web smith decorators purchased office supplies on account for $500. Web smith decorating services pays $200 cash for rent expense. 5.0 (1 review) williams travel service purchased office supplies. We analyzed this transaction as increasing the asset supplies and the liability accounts. In accounting, the. Smith Decorators Purchased Office Supplies On Account For 500.

From www.fity.club

Purchased Smith Decorators Purchased Office Supplies On Account For 500 5.0 (1 review) williams travel service purchased office supplies. Ten days later smith pays off its obligation. Web smith decorators purchased office supplies on account for $500. Assets $30,000 = liabilities $0 + equity $30,000. We analyzed this transaction as increasing the asset supplies and the liability accounts. How would this transaction affect the accounting. Purchased office supplies on account. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved These are the options for the account titles (middle Smith Decorators Purchased Office Supplies On Account For 500 Purchased office supplies on account for $ 6,500. Web let’s check the accounting equation: Web purchased $500 in supplies on account. Assets $30,000 = liabilities $0 + equity $30,000. Web smith decorating services pays $200 cash for rent expense. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Smith. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved The following transactions occurred during March 2024 Smith Decorators Purchased Office Supplies On Account For 500 We analyzed this transaction as increasing the asset supplies and the liability accounts. 5.0 (1 review) williams travel service purchased office supplies. How would this transaction affect the accounting. Web purchased $500 in supplies on account. Purchased office supplies on account for $ 6,500. Smith decorators purchased office supplies on account for. In accounting, the company usually records the office. Smith Decorators Purchased Office Supplies On Account For 500.

From www.coursehero.com

[Solved] Create Cashflows May 1 G. Gram invested 40,000 cash in the Smith Decorators Purchased Office Supplies On Account For 500 Smith decorators purchased office supplies on account for. In accounting, the company usually records the office supplies bought in as the asset as they are not being used. Web purchased $500 in supplies on account. We analyzed this transaction as increasing the asset supplies and the liability accounts. How would this transaction affect the accounting. Web smith decorators purchased office. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved TransactionsSimmons Consulting Co. has the following Smith Decorators Purchased Office Supplies On Account For 500 Assets $30,000 = liabilities $0 + equity $30,000. We analyzed this transaction as increasing the asset supplies and the liability accounts. Smith decorators purchased office supplies on account for. Web smith decorators purchased office supplies on account for $500. Web let’s check the accounting equation: Purchased office supplies on account for $ 6,500. In accounting, the company usually records the. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved Account Debited Account Credited Cash Cash Salaries Smith Decorators Purchased Office Supplies On Account For 500 Web smith decorating services pays $200 cash for rent expense. Assets $30,000 = liabilities $0 + equity $30,000. Purchased office supplies on account for $ 6,500. Smith decorators purchased office supplies on account for. Ten days later smith pays off its obligation. Web smith decorators purchased office supplies on account for $500. Web let’s check the accounting equation: 5.0 (1. Smith Decorators Purchased Office Supplies On Account For 500.

From www.chegg.com

Solved Journalizing and Posting Transactions Smith Decorators Purchased Office Supplies On Account For 500 In accounting, the company usually records the office supplies bought in as the asset as they are not being used. 5.0 (1 review) williams travel service purchased office supplies. Purchased office supplies on account for $ 6,500. Web purchased $500 in supplies on account. Web let’s check the accounting equation: Smith decorators purchased office supplies on account for. We analyzed. Smith Decorators Purchased Office Supplies On Account For 500.